50K a year is equivalent to about $24 per hour. This calculation is based on a 40-hour workweek.

Earning a salary of 50,000 dollars annually is a common benchmark for many professionals. However, breaking down this figure into an hourly rate can provide a clearer perspective on the value of one’s time. At $24 per hour, individuals can assess their earnings more granularly, whether for budgeting purposes or negotiating hourly wages.

Understanding the hourly equivalent of a yearly salary can also help individuals gauge the compensation for part-time work or freelance projects. By knowing the hourly rate, individuals can make informed decisions about their income and ensure they are being fairly compensated for their time and expertise.

Credit: www.howtofire.com

Breaking Down Annual Salaries

Understanding how much a yearly salary translates into an hourly wage can be helpful for both employees and employers. By breaking down annual salaries into their hourly equivalents, individuals can gain a clearer picture of the value of their time and make informed decisions regarding their financial goals. In this article, we will explore the basics of calculating hourly wages and provide conversion factors to assist in the process.

Hourly Wage Basics

Hourly wages are a common method of compensation for many jobs. They are often used for part-time positions or those with varying work hours. Calculating your hourly wage is relatively simple. You divide your annual salary by the number of hours you work in a year. However, it’s important to account for factors like paid time off and any unpaid breaks when determining your actual working hours.

Annual To Hourly Conversion Factors

Converting an annual salary to an hourly rate can be useful for both employees and employers. It allows individuals to compare their wages to industry standards, negotiate fair compensation, and budget their finances effectively. Employers can also benefit from understanding the hourly equivalent of salaries, as it helps with cost analysis and ensures employees are appropriately compensated.

To convert an annual salary to an hourly rate, you need to know the number of hours worked in a year. The standard is typically considered to be 2,080 hours, which is derived from an average of 40 hours worked per week for 52 weeks. However, this may vary depending on specific work arrangements.

Let’s break it down with an example:

| Annual Salary | Hourly Rate (based on 2,080 hours) |

|---|---|

| $50,000 | $24.04 |

How Much is 50K a Year Hourly? Using the standard of 2,080 hours per year, a $50,000 annual salary would equate to an approximate hourly rate of $24.04. This means that for every hour worked, the individual would earn around $24.04.

It’s important to note that this calculation provides a rough estimate and may not account for additional factors such as overtime pay, bonuses, or deductions. To get a more accurate representation of your hourly wage, it is advisable to consult your employer or refer to your employment contract.

By understanding the basics of calculating hourly wages and utilizing conversion factors, individuals can gain valuable insights into their earning potential and make informed decisions about their financial future. Whether you are an employee seeking fair compensation or an employer striving for equitable wages, breaking down annual salaries into hourly rates is a valuable tool.

The Math Behind $50k A Year

Explore the math behind earning $50K a year by breaking it down hourly. Calculating it hourly reveals the value of each hour worked towards achieving the annual income goal. Understanding the hourly value can help in better financial planning and goal setting.

When it comes to calculating your annual income, it’s essential to understand the math behind it. A salary of $50,000 a year may seem like a decent wage, but how much does it translate to per hour? In this blog post, we’ll dive into the nitty-gritty of the math behind a $50K yearly income and how it breaks down into an hourly wage.

Standard Workweek Calculations

Assuming a standard 40-hour workweek, a $50,000 salary would equate to an hourly wage of approximately $24.04. This calculation is determined by dividing the annual salary by the number of hours worked in a year. To break it down further, let’s look at the following table:

| Calculation | Result |

|---|---|

| $50,000 ÷ 52 weeks | $961.54 per week |

| $961.54 ÷ 40 hours | $24.04 per hour |

Accounting For Overtime And Bonuses

If you work overtime hours or receive bonuses, your hourly wage may increase. For example, if you work an additional 10 hours of overtime per week, your hourly wage would increase to approximately $31.38. This calculation is determined by adding your overtime pay to your base pay and dividing by the total number of hours worked. To illustrate this, let’s look at the following table:

| Calculation | Result |

|---|---|

| $50,000 + (10 hours × $24.04 × 1.5) | $54,605 per year |

| $54,605 ÷ 52 weeks | $1,050.09 per week |

| $1,050.09 ÷ 50 hours | $21.00 per hour (base pay) |

| $24.04 × 1.5 | $36.06 (overtime pay) |

| $21.00 + $36.06 | $57.06 (hourly wage with overtime) |

In conclusion, understanding the math behind your annual income is crucial to making informed financial decisions. Whether you’re negotiating a salary or considering overtime opportunities, knowing your hourly wage can help you make the most of your earnings.

Understanding The 50k Lifestyle

Discovering the 50K lifestyle unveils the value of understanding how much 50K a year translates to hourly. It’s essential to grasp the hourly rate to manage finances effectively and make informed decisions regarding budgeting and expenses.

When it comes to understanding the 50K lifestyle, it’s important to take into account the cost of living considerations and how to effectively budget on a 50K income. With an annual salary of $50,000, it’s essential to manage your finances wisely to make the most out of your earnings. By examining the cost of living and implementing a budget, you can ensure a comfortable lifestyle while staying within your means.

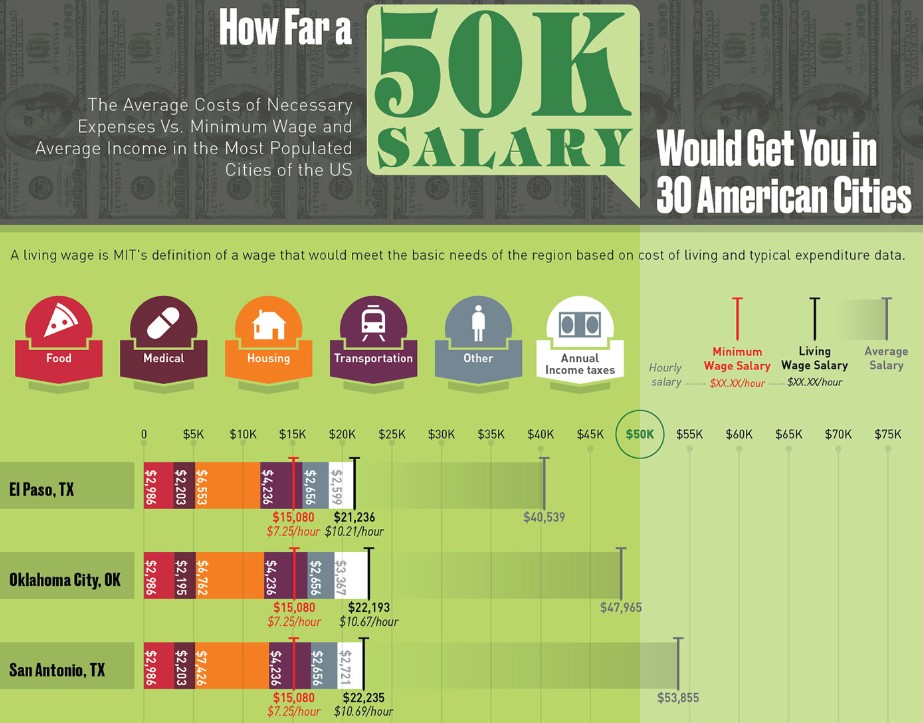

Cost Of Living Considerations

Before diving into budgeting, it’s crucial to consider the cost of living. Various factors, such as location, housing, transportation, and healthcare, influence how much you need to spend to sustain a certain lifestyle. By understanding the cost of living in your area, you can better allocate your resources and make informed financial decisions.

Budgeting On A 50k Income

Budgeting is key to managing your 50K income effectively. By creating a budget, you can prioritize your expenses, track your spending, and save for future goals. Here’s a breakdown of how you can budget on a 50K income:

- Calculate your monthly income: Divide your annual salary by 12 to determine your monthly income, which in this case would be approximately $4,166.

- Track your expenses: Keep a record of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any other recurring bills.

- Identify areas to cut back: Analyze your spending habits to identify areas where you can cut back. This could include reducing dining out, entertainment expenses, or finding ways to save on utilities.

- Create a budget: Allocate a specific portion of your income to each expense category. This helps you stay on track and avoid overspending.

- Save for emergencies and future goals: Set aside a portion of your income for emergencies and long-term goals, such as retirement or buying a house.

By following these budgeting tips, you can make the most out of your 50K income and achieve financial stability.

Comparing Full-time And Part-time Earnings

Pro-rata Hourly Rates

When working full-time, a salary of $50,000 per year translates to approximately 40 hours per week. This equates to a pro-rata hourly rate of $24.04. On the other hand, part-time work may involve reduced hours, affecting the hourly rate.

Impact Of Reduced Hours On Annual Income

Working part-time with reduced hours can significantly impact annual income. For instance, if the reduced hours result in working only 20 hours per week, the hourly rate would double to $48.08, but the annual income would be halved to $25,000.

Tax Implications On $50k Salary

When it comes to understanding the tax implications of a $50,000 annual salary, it’s essential to consider both federal and state taxes, as well as estimating your take-home pay. These factors play a significant role in determining how much you actually earn on an hourly basis. Let’s dive into the details!

Federal And State Taxes

Calculating federal and state taxes accurately is crucial for determining your hourly wage. The amount you owe in taxes depends on various factors such as filing status, deductions, and tax credits. Let’s break it down:

| Tax Type | Percentage |

|---|---|

| Federal Income Tax | Varies based on tax bracket |

| State Income Tax | Varies by state |

| Social Security Tax | 6.2% of the first $142,800 |

| Medicare Tax | 1.45% |

Remember, these percentages are approximate and subject to change. It’s crucial to consult with a tax professional or use reliable online tax calculators to determine your exact tax liability.

Take-home Pay Estimation

After accounting for federal and state taxes, estimating your take-home pay becomes essential. Your take-home pay is the actual amount you receive in your bank account. Consider the following:

- Deduct federal income tax from your salary based on your tax bracket.

- Subtract state income tax based on your state’s tax rate.

- Calculate Social Security tax by multiplying your salary by 6.2%.

- Calculate Medicare tax by multiplying your salary by 1.45%.

- Subtract the total tax amount from your annual salary to determine your take-home pay.

Keep in mind that these estimations may not account for other deductions such as healthcare premiums, retirement contributions, or other employer benefits. It’s always a good idea to review your paycheck and consult with your employer’s HR department for a comprehensive breakdown of your take-home pay.

Understanding the tax implications on a $50,000 salary is crucial for managing your finances effectively. By familiarizing yourself with federal and state tax rates and estimating your take-home pay, you can plan your budget accordingly and make informed financial decisions.

Credit: www.titlemax.com

50k Across Different Industries

Sector Wage Variances

50K a year translates to an hourly wage that varies across different industries. Let’s delve into the wage variances that exist in various sectors.

Career Progression And Salary Growth

As we explore the hourly equivalent of a 50K annual income, it’s essential to consider career progression and salary growth in different industries. Let’s analyze how these factors impact the hourly rates.

Geographical Influence On Salary

The geographical influence on salary can significantly impact how much $50,000 a year translates to hourly. In areas with higher living costs, the hourly rate may be lower, while in more affordable regions, it could be higher. It’s essential to consider location when evaluating the true value of a salary.

Cost Of Living By Region

costs of living.

Adjusting For Purchasing Power

Salaries need to be adjusted based on purchasing power differences.

Planning For The Future On $50k A Year

Planning for the future on a $50K annual income requires understanding its hourly equivalent. By calculating the hourly rate, individuals can better manage their finances and make informed decisions regarding budgeting, savings, and investment opportunities. It’s crucial to consider this perspective when strategizing for a secure financial future.

Saving Strategies

Start saving early to build financial security.

Create a budget and stick to it.

Investment And Retirement Planning

Consider investing a portion of your income.

Explore retirement account options like 401(k) or IRA.

Credit: timehackhero.com

Frequently Asked Questions

What Is The Hourly Rate For A $50,000 Salary?

The hourly rate for a $50,000 salary is approximately $24. 04, based on a standard 40-hour workweek. This calculation is derived by dividing the annual salary by 2080, the number of work hours in a year.

How Does A $50,000 Salary Compare To Hourly Wages?

A $50,000 annual salary equates to a competitive hourly wage, offering financial stability and opportunities for savings and investments. Understanding the hourly rate allows individuals to make informed decisions regarding their earnings and budget.

Can A $50,000 Yearly Salary Meet Living Expenses?

With careful budgeting and financial planning, a $50,000 annual salary can cover living expenses in many regions. However, cost of living factors such as housing, utilities, and transportation should be considered when assessing the adequacy of this income level.

Conclusion

To sum up, calculating your hourly rate based on an annual salary of $50,000 requires simple math. Divide the annual salary by the number of hours worked in a year to get the hourly rate. Keep in mind that the hourly rate may vary depending on factors such as overtime pay and benefits.

Knowing your hourly rate can help you better manage your finances and negotiate your salary. So, if you’re wondering how much $50,000 a year is hourly, now you have the answer!