A woman should ask for protection of inheritances, family gifts, trusts, and endowments in a prenup. This safeguards her assets and prevents future disputes regarding separate property.

When entering into a marriage, it’s essential to consider the financial implications and protect individual interests. By outlining specific provisions in a prenup, women can secure their financial well-being and clarify property rights in case of divorce. It’s important to address alimony, asset division, and any unique circumstances that may impact the financial aspects of the relationship.

Open communication and transparency are key in discussing prenuptial agreements to ensure both parties are aware of their rights and responsibilities.

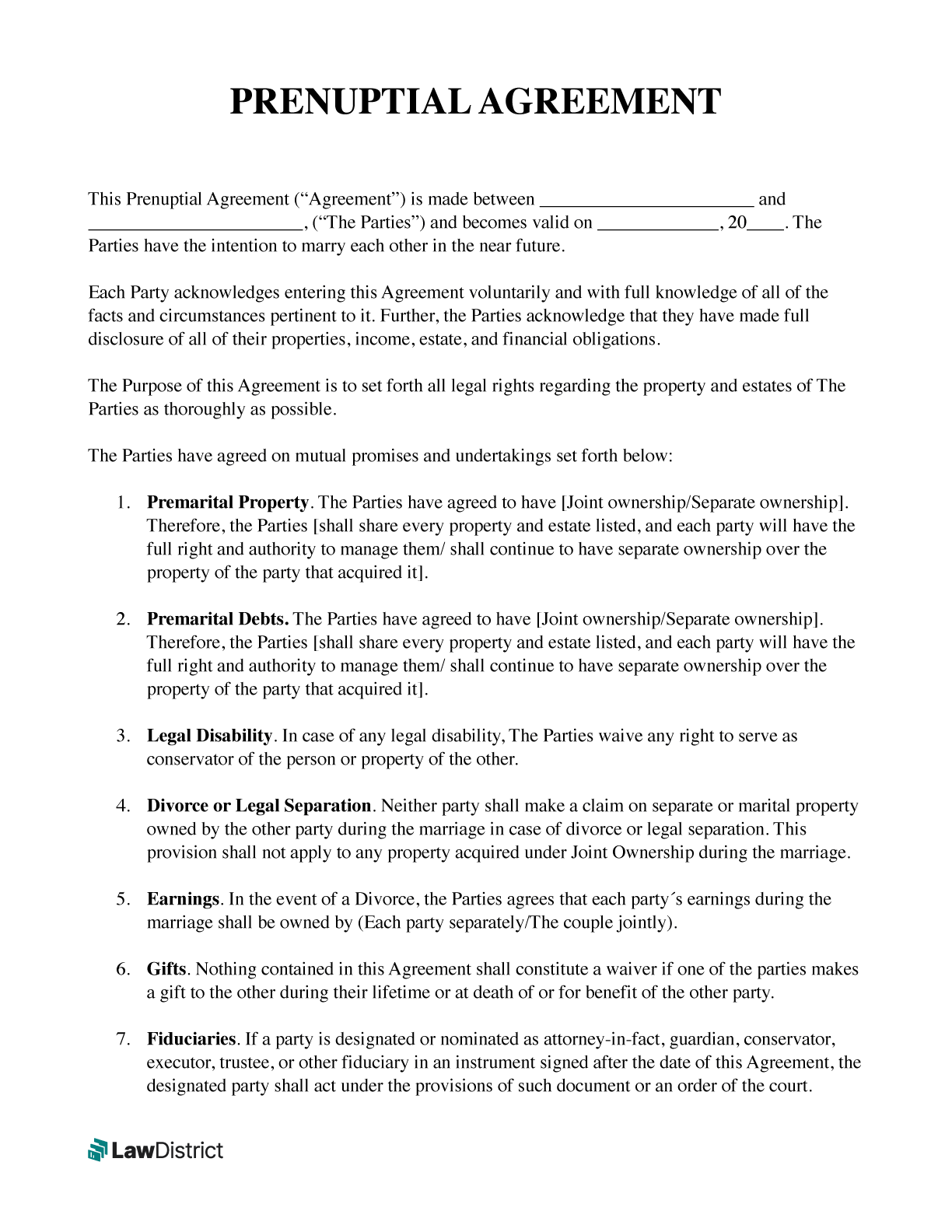

Introduction To Prenuptial Agreements

To protect her interests in family money and prevent commingling arguments down the road, a woman should specify in her prenup that inheritances, family gifts, trusts, will disbursements, and other endowments remain separate property, regardless of how they are used.

It’s important to consider specific alimony provisions based on the individual situation, such as the length of time spent out of the workforce.

A prenuptial agreement, commonly known as a prenup, is a legally binding contract that couples sign before getting married. It outlines the division of assets, spousal support, and other financial matters in the event of divorce or death. While prenups are often associated with protecting assets, they can also serve as a tool for open communication and financial transparency between partners.

The Purpose Of A Prenup

One of the primary purposes of a prenup is to protect each spouse’s assets and define how they will be divided in case of divorce. It can also address potential alimony or spousal support, ensuring that both parties are aware of their financial rights and responsibilities. Additionally, a prenup can safeguard family inheritances and business interests, providing clarity and security for both spouses.

Common Misconceptions

There are several misconceptions surrounding prenuptial agreements. Contrary to popular belief, prenups are not solely for the wealthy. They can benefit individuals with any level of assets and financial responsibilities. Another common misconception is that prenups are a sign of mistrust. In reality, they can promote honest conversations about finances and future expectations, ultimately strengthening the foundation of a marriage.

Asset Protection Strategies

In a prenup, a woman should ensure that inheritances, gifts, trusts, and other assets remain separate to protect her interests and prevent future disputes over commingling. This helps safeguard family money and maintains financial clarity in the marriage.

Separate vs. Marital Property In a prenup, clearly define separate property as assets owned before marriage, maintaining their individual ownership. Marital property includes assets acquired during marriage, subject to division. Inheritance and Family Gifts Specify that inheritances and family gifts are separate property. Determine how these assets will be managed and prevent them from becoming marital assets.Separate Vs. Marital Property

– Separate Property: Assets owned before marriage. – Marital Property: Assets acquired during marriage, subject to division.Inheritance And Family Gifts

– Inheritances and family gifts should be classified as separate property. – Prevent these assets from becoming marital property through clear terms.Financial Responsibilities

To safeguard her financial future, a woman should include provisions for asset protection, alimony terms, property rights clarification, and spousal support in a prenuptial agreement. It’s crucial to address inheritances, trusts, family gifts, and endowments as separate property to prevent disputes later on.

Managing Debt In Marriage

It’s crucial to address financial responsibilities, including debt management, in a prenuptial agreement. By clearly outlining how debt will be handled during the marriage and in the event of divorce, both parties can protect their financial well-being.

Pre-marital Debt Considerations

Before entering into a marriage, it’s essential to discuss each person’s pre-existing debts. This includes student loans, credit card debt, mortgages, and any other liabilities. By understanding and documenting these obligations in the prenup, both parties can safeguard their individual financial interests.

Credit: www.wikihow.com

Alimony And Spousal Support

When it comes to a prenuptial agreement, it’s essential for women to address the topic of alimony and spousal support. This can help ensure financial security and peace of mind in the event of a divorce. Here are some key considerations when including provisions related to alimony and spousal support in a prenup:

Calculating Alimony

Calculating alimony in a prenuptial agreement involves determining the amount and duration of spousal support payments in the event of a divorce. Factors such as the length of the marriage, each spouse’s financial situation, and the standard of living during the marriage should be taken into account when calculating alimony.

Conditions For Modification

Conditions for modification of alimony provisions should be clearly outlined in the prenup. This may include circumstances under which the amount or duration of spousal support can be modified, such as a change in either spouse’s financial status or remarriage.

Property Division

When considering property division in a prenuptial agreement, it’s essential for women to thoroughly evaluate their real estate assets. This includes the family home, vacation properties, and any real estate investments. Clearly outlining the ownership and distribution of these properties in the prenup can prevent potential disputes and provide clarity in the event of a divorce.

Another crucial aspect of property division to address in a prenup is the ownership and valuation of any businesses owned by either party. Determining how the business will be handled in the event of a divorce, including valuation methods and distribution of shares, can safeguard women’s interests and prevent complex legal battles.

Estate Planning And Inheritance

Estate planning and inheritance are crucial aspects of a prenuptial agreement for women. These provisions ensure that a woman’s assets and future earnings are protected in the event of a divorce or death of a spouse. Here are the key considerations under estate planning and inheritance when it comes to prenuptial agreements:

Trusts And Wills

Women should consider addressing trusts and wills in their prenuptial agreements to safeguard their inheritance and estate planning. This involves specifying the distribution of assets held in trusts and wills to ensure that they are protected and allocated according to their wishes in the event of a divorce or the death of a spouse. Additionally, it can outline provisions for any future inheritances or bequests, providing clarity and protection for women’s assets.

Protecting Future Earnings

Another critical aspect for women to include in a prenup is the protection of their future earnings. This can involve outlining provisions that safeguard any income, investments, or business interests acquired during the marriage, ensuring that they remain separate property in the event of a divorce. By addressing future earnings in the prenuptial agreement, women can protect their financial independence and assets accumulated during the marriage.

Infidelity And Lifestyle Clauses

Infidelity clauses in prenuptial agreements outline the consequences of a partner engaging in extramarital affairs. These clauses can include financial penalties or even grounds for divorce. By addressing infidelity upfront, couples can establish trust and set clear expectations.

Enforceability Of Lifestyle Clauses

Lifestyle clauses in prenups dictate certain behaviors or lifestyle choices during the marriage. These clauses can cover areas such as weight gain, social media conduct, or even frequency of intimacy. However, the enforceability of lifestyle clauses can vary depending on state laws and judicial interpretation.

Credit: www.familylawprotection.com

Legal And Financial Advice

When it comes to creating a prenuptial agreement, seeking legal and financial advice is crucial for ensuring that both parties receive fair representation and protection of their interests. Here are the key aspects to consider when seeking legal and financial advice for a prenup:

Choosing The Right Attorney

Choosing the right attorney is the first step in the process of creating a prenuptial agreement. It’s essential to find a lawyer who specializes in family law and has experience in drafting prenups. Look for an attorney who is knowledgeable about the specific laws and regulations in your state regarding prenuptial agreements.

Moreover, it’s important to select an attorney who can provide personalized attention and understands your individual financial situation. A competent attorney will guide you through the legal process, explain your rights, and ensure that your best interests are represented in the agreement.

Negotiation And Fair Representation

During the negotiation phase, it’s imperative to have legal and financial advisors who can provide valuable insights and ensure that the terms of the prenup are fair and equitable for both parties. This involves a thorough review of all financial disclosures and a clear understanding of each party’s rights and obligations.

Seeking fair representation means that both parties should have the opportunity to express their concerns and preferences regarding the prenup. A skilled attorney will facilitate open communication and help negotiate terms that align with the interests of both parties.

Credit: www.lawdistrict.com

Frequently Asked Questions

What Should A Woman Put In Her Prenup?

Specify in a prenup that inheritances, gifts, trusts, and endowments remain separate property to avoid future disputes and protect your financial interests.

What Should You Not Agree To A Prenup?

Avoid including child custody, child support, alimony, day-to-day matters, and anything prohibited by law in a prenup.

What Questions To Ask About A Prenup?

When considering a prenup, it’s important to ask about assets and debts brought into the marriage, handling of premarital assets in case of divorce, and whether separate property will be commingled with marital property. It’s also important to note that child custody and support cannot be included in a prenup, and any provisions dealing with those matters will not be upheld by the court.

Additionally, consider including specific alimony provisions based on your situation and protecting any assets brought into the marriage.

What Are Five Things That Cannot Be Included In A Prenuptial Agreement?

A prenuptial agreement cannot include child custody, child support, alimony, day-to-day household matters, or anything prohibited by law.

Conclusion

A woman should ask for protection of inheritances, family gifts, trusts, and endowments in a prenup. This safeguards her interests and avoids disputes over separate property in the future. Clarifying these details upfront can provide peace of mind for both parties.