To read a check, locate the payee, date, amount, and signature on the front side. Verify details for accuracy.

When depositing, endorse the back by signing. Checks can be deposited or cashed at banks. Online banking allows for mobile check deposits, making the process more convenient. Understanding how to read a check is essential for managing personal finances effectively.

By following these simple steps, you can confidently handle checks and ensure secure transactions. Let’s explore the key elements of reading a check and how to do it correctly.

Decoding The Front Of A Check

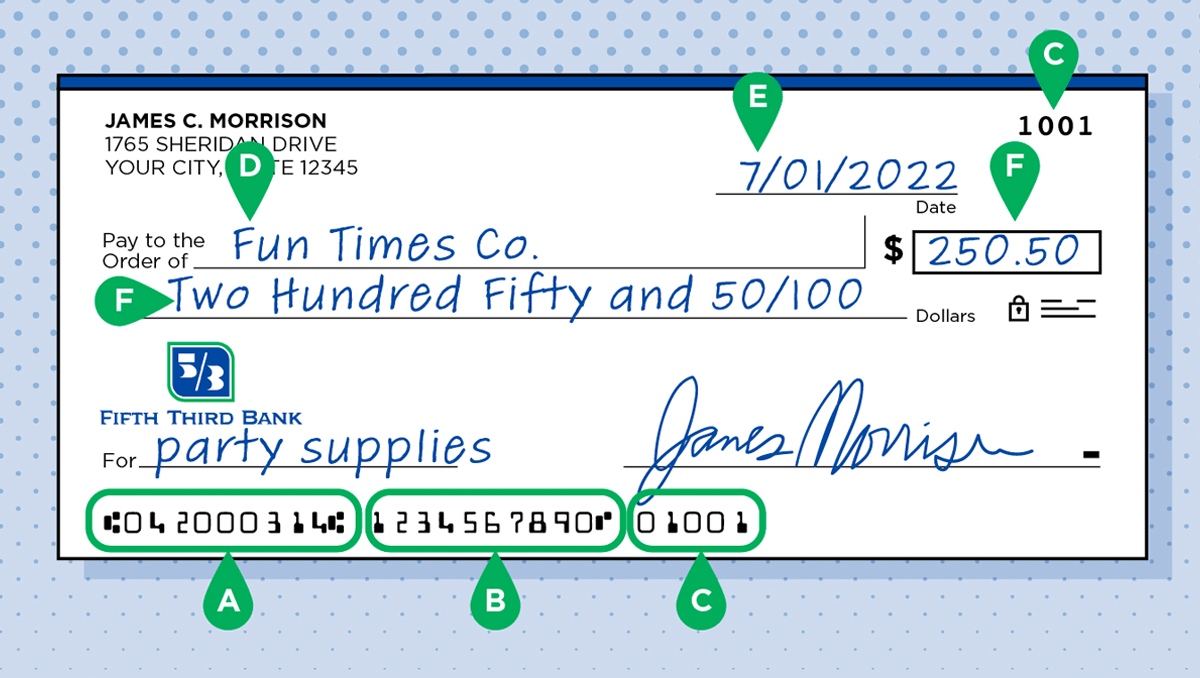

When it comes to handling financial transactions, understanding how to read a check is essential. The front of a check contains various important elements that provide crucial information about the payment. In this section, we will decode the front of a check, focusing on the personal information, payee line, numeric amount box, written amount line, and date field.

Personal Information

The personal information section of a check typically includes the name and address of the account holder. This information is important for identification purposes and ensures that the check is being used by the intended recipient. It is crucial to verify that the personal information matches your own or the intended payee’s details to avoid any discrepancies.

Payee Line

The payee line is where the name of the person or organization receiving the payment is written. It is important to accurately fill in the payee line to ensure that the funds go to the intended recipient. Always double-check the spelling and ensure that the payee’s name is correctly written to avoid any issues or delays in processing the check.

The Numeric Amount Box

The numeric amount box is where the numerical value of the payment is written. It is crucial to accurately fill in this box to ensure that the correct amount is deducted from your account. Make sure to write the amount clearly and use decimal points where necessary. Always review the numeric amount box to avoid any errors that could lead to incorrect payments.

The Written Amount Line

The written amount line is where the payment amount is spelled out in words. This is an important security measure to prevent any alteration of the payment amount. It is crucial to write the amount in words correctly, ensuring it matches the numeric amount box. If there are any discrepancies between the written amount line and the numeric amount box, banks will typically refer to the written amount as the official payment amount.

Date Field

The date field on a check indicates the date the check was issued. It is important to accurately fill in the date to ensure that the check is valid and can be processed. Banks typically require checks to be deposited or cashed within a certain period from the date written on the check. Always review the date field to ensure it is current and within the acceptable timeframe.

By understanding and decoding the front of a check, you can ensure accurate and secure financial transactions. Paying attention to personal information, the payee line, the numeric amount box, the written amount line, and the date field will help you avoid any issues or delays in processing your payments.

Credit: www.53.com

Understanding Check Numbers

Understanding check numbers is an essential part of reading a check. Each number on a check serves a specific purpose, and understanding them can help ensure the accuracy of your transactions.

Check Sequence Number

The check sequence number, also known as the check number, is a unique identifier printed on each check. It typically appears at the top right and bottom right corners of the check. This number helps track the order in which checks are written and processed.

Account Number Significance

The account number, located at the bottom of the check, is a crucial component for identifying the specific bank account associated with the check. It is essential for electronic transactions and serves as a reference for financial institutions.

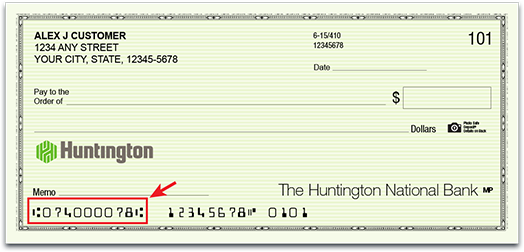

Routing Number Breakdown

The routing number, positioned at the bottom of the check, is a nine-digit code that identifies the financial institution where the account is held. It is used for various purposes, including electronic funds transfers and direct deposits.

The Memo Line: Optional But Useful

When it comes to reading a check, one important section that you should pay attention to is the memo line. While it may be optional, understanding the purpose and potential usage of the memo line can provide you with valuable information about the payment. In this section, we will explore the purpose of the memo line and provide examples of how it can be used. Let’s dive in!

Purpose Of The Memo Line

The memo line is typically located in the bottom left corner of a check, right next to the signature line. Its purpose is to allow the payer to include a brief note or description regarding the payment. While it may seem insignificant, the memo line can be quite useful for both the payer and the payee.

For the payer, including a memo can serve as a reminder of the purpose of the payment. This can be particularly helpful when writing multiple checks or making recurring payments. By including a clear and concise memo, the payer can ensure that the intended recipient understands the purpose of the payment without the need for additional communication.

On the other hand, the payee can benefit from the memo line by easily identifying the nature of the payment. Whether it is a payment for rent, utilities, or a specific purchase, the memo line provides a quick reference point for the payee to associate the payment with the appropriate transaction. This can help in organizing finances and keeping track of incoming payments.

Examples Of Memo Usage

The memo line can be used in various ways to provide specific details about the payment. Here are a few examples:

| Memo | Description |

|---|---|

| July Rent | Indicates that the payment is for the rent due in the month of July. |

| Invoice #12345 | Refers to the invoice number associated with the payment, making it easier for the payee to match the payment with the corresponding invoice. |

| Birthday Gift | Specifies that the payment is a birthday gift, which can be helpful for the recipient when reconciling their finances. |

As you can see, the memo line can be used to provide specific information that adds context to the payment. By utilizing the memo line effectively, both the payer and the payee can streamline their financial processes and ensure accurate record-keeping.

Signature Line: The Seal Of Authorization

In the world of finance, a check is a crucial document that represents the transfer of funds from one account to another. To ensure the validity and authenticity of a check, there is a specific section known as the signature line. This line serves as the seal of authorization, indicating that the check has been approved and authorized by the account holder. Understanding the importance of the signature line and its security implications is essential for anyone involved in financial transactions.

Importance Of The Signature

The signature on a check holds immense significance as it acts as a personal verification and authorization by the account holder. It serves as a legally binding agreement between the account holder and the recipient of the check. The presence of a signature confirms that the account holder has authorized the transfer of funds and accepts responsibility for the payment. Without a valid signature, the check may be considered invalid, and the transaction may not be processed.

Security Implications

The signature line on a check plays a crucial role in ensuring the security of financial transactions. It acts as a deterrent against fraudulent activities and unauthorized access to funds. When the account holder signs the check, it creates a unique mark that helps verify their identity and prevents unauthorized individuals from cashing or depositing the check. It provides a layer of protection against check forgery and helps financial institutions authenticate the check’s validity.

It is vital to safeguard the signature line and prevent it from falling into the wrong hands. Any unauthorized access to the signature can lead to check fraud, identity theft, and financial loss. Therefore, it is recommended to keep checks in a secure place and refrain from signing blank checks or leaving the signature line empty.

Understanding the importance of the signature line and the security implications associated with it enables individuals to exercise caution and diligence when handling checks. By ensuring the presence of a valid signature, one can enhance the security of financial transactions and maintain the integrity of the banking system.

The Flip Side: Endorsement Area

When it comes to reading a check, understanding the endorsement area on the back is essential. This is where the payee endorses or signs the check to cash or deposit it. Let’s take a closer look at the flip side of a check: the endorsement area.

Types Of Endorsements

There are several types of endorsements that can be used when signing a check. The most common types include:

- Blank endorsement

- Special endorsement

- Restrictive endorsement

- Qualified endorsement

Endorsement Instructions

When endorsing a check, it’s important to follow specific instructions to ensure it can be processed correctly. Here are some general guidelines to keep in mind:

- Sign the check exactly as your name appears on the front.

- If the check is jointly payable, all payees must endorse the check.

- Include any additional instructions, such as “For deposit only,” if needed.

Credit: www.gobankingrates.com

Security Features On Checks

Watermarks And Security Threads

Watermarks and security threads are common security features found on checks to prevent counterfeiting. These features are often embedded into the paper and are visible when held up to the light.

Microprinting And Signature Lines

Microprinting involves tiny, difficult-to-replicate text that is often found on the signature line or other areas of the check. Signature lines are designed to prevent unauthorized alterations to the check by providing a designated space for the account holder to sign.

Electronic Processing Of Checks

When it comes to the electronic processing of checks, understanding how checks are transformed from physical documents into electronic data is crucial.

The Check 21 Act

Implemented in 2004, The Check 21 Act allows banks to create digital versions of paper checks, enabling faster and more efficient processing.

From Physical To Electronic: The Process

- Checks are scanned to convert them into digital images.

- These images are then transmitted electronically to the relevant financial institutions.

- Verification and validation processes are conducted on the electronic data.

- Finally, the funds are electronically transferred between accounts.

Common Mistakes To Avoid When Writing Checks

When writing checks, it is crucial to be meticulous to avoid common errors that could lead to complications. Let’s explore some of the key mistakes to steer clear of:

Incorrect Date Usage

- Check the date format for accuracy.

- Use the current date to prevent delays.

- Avoid post-dating checks to ensure timely processing.

Mismatched Amounts

- Double-check the numerical and written amounts.

- Ensure consistency to prevent discrepancies.

- Verify the recipient’s name and amount match.

Forgetting To Sign

- Always sign the check to validate it.

- Use your legal signature for security.

- Missing signature could render the check invalid.

Leaving Fields Blank

- Fill out all fields to avoid confusion.

- Include payee, amount, and signature details.

- Leaving blank fields may lead to misuse or errors.

Practical Tips For Check Handling

When handling checks, it is crucial to follow best practices to ensure security and accuracy. Here are some practical tips for efficient check handling:

Recording Check Transactions

- Record all check transactions promptly in your check register.

- Include the date, payee, check number, and amount for each transaction.

- Reconcile your check register with your bank statement regularly.

Safe Storage Of Checkbooks

- Keep your checkbook in a secure and locked location when not in use.

- Avoid leaving blank checks or signed checks unattended.

- Destroy old checks or checkbooks securely to prevent fraud.

Regular Account Monitoring

- Review your bank statements monthly for any unauthorized transactions.

- Report any discrepancies or suspicious activities to your bank immediately.

- Set up account alerts for unusual account activity for added security.

Credit: www.huntington.com

Frequently Asked Questions

How Do I Read A Check?

To read a check, start by looking at the date, payee, and amount fields. Then, verify the amount written in words matches the numerical amount. Finally, sign the check and endorse it if needed.

What Is The Routing Number On A Check?

The routing number on a check is a 9-digit code that identifies the bank where the account is held. It is located on the bottom left corner of the check, followed by the account number.

Can I Deposit A Check Without A Signature?

No, you cannot deposit a check without a signature. The signature is a crucial part of the check, as it verifies that the account holder authorized the transaction. Without a signature, the check would be considered invalid.

Conclusion

Knowing how to read a check is an essential life skill that can save you from financial errors and fraud. By following the steps outlined in this post, you can confidently read and understand the information on a check. Remember to always double-check the details before depositing or cashing a check to avoid any potential issues.

With practice, you’ll become a pro at reading checks in no time. Keep these tips in mind and stay financially savvy!